Many websites on the internet are monetized with ads, such as news sites, educational sites, blogs, social media sites, and gaming sites. In this article, I review how website ad revenue is calculated and develop equations to estimate ad income over time. Furthermore, I develop models to forecast the revenue of a growing website. I hope that these tools will be useful for fellow website owners, providing financial planning and conceptual insights. Overall, these calculations show that online businesses require patient persistence and the consistent production of new content for fiscal success.

Monetizing websites with ads

There are rather few revenue-earning strategies available to online content providers. One possibility is to sell your own product or service. Unfortunately, this is not as amenable to all website types. For instance, many blogs and informational websites sole product is their content/articles, my website being a good example of this. In this case, I could choose to put some (or all) of the content behind a paywall, requiring users to buy a subscription to view it. In fact, some news companies and magazines have taken this approach. Despite its simplicity, this method would be highly antithetical to my goal of sharing my thoughts, providing educational materials, and reaching as many people as possible. A final alternative is advertising, where people’s attention is ultimately the product sold to advertisers. Though ads can be distracting for viewers, the reality is that keeping a website up and producing content for it is expensive. In lieu of a better alternative, online advertising appears to currently be a necessary evil.

There are a variety of online advertising approaches, but display ads are the most ubiquitous. Here the website owner is paid in exchange for presenting a sponsor’s ad. There are different payment models through which the website owner can be compensated. The most common approach is cost-per-click (CPC). In this case, the advertiser is billed only when a user clicks on the advertisement, usually linking them to the business’s website. Another approach is CPM (cost per mile) ads. Here the advertiser is billed per thousand ad impressions. Because impressions do not guarantee the user saw or engaged with the ad, CPM ads generally offer much lower payout. Nonetheless, this payment structure is more appropriate in situations where a business is trying to build general brand awareness instead of selling a particular product. Recently, Google has introduced a new compensation format that address the limitations of traditional CPM ads, “active view” CPM ads. Here the advertiser is only billed when users actually view the ad. This is defined as at least half of the ad being visible on the user’s screen for at least a second. A final, less common bid type is CPE (cost-per-engagement) where the user must perform an action on the ad unit for the advertiser to be charged.

There are a variety of online advertising approaches, but display ads are the most ubiquitous. Here the website owner is paid in exchange for presenting a sponsor’s ad. There are different payment models through which the website owner can be compensated. The most common approach is cost-per-click (CPC). In this case, the advertiser is billed only when a user clicks on the advertisement, usually linking them to the business’s website. Another approach is CPM (cost per mile) ads. Here the advertiser is billed per thousand ad impressions. Because impressions do not guarantee the user saw or engaged with the ad, CPM ads generally offer much lower payout. Nonetheless, this payment structure is more appropriate in situations where a business is trying to build general brand awareness instead of selling a particular product. Recently, Google has introduced a new compensation format that address the limitations of traditional CPM ads, “active view” CPM ads. Here the advertiser is only billed when users actually view the ad. This is defined as at least half of the ad being visible on the user’s screen for at least a second. A final, less common bid type is CPE (cost-per-engagement) where the user must perform an action on the ad unit for the advertiser to be charged.

Advertising revenue

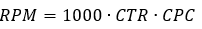

In this section, I develop equations to calculate expected advertising revenue. As discussed above, many advertising bid types pay per thousand ad impressions (CPM). In contrast, CPC ads only pay upon clicks. To compare the revenue generated by both bid types, it is useful to compute the revenue per thousand ad impressions (RPM) for CPC ad revenue. An important metric associated with CPC ads is the click-through ratio (CTR), the portion of impressions for which a user clicks the advertisement. Multiplying the CTR by 1000 gives the expected number of clicks per thousand impressions. We can further multiply this by the average cost per click to find the expected revenue per thousand impressions:

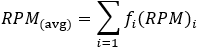

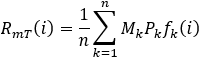

Many advertising networks, such as Google Adsense, provide ads with a mix of bid types. Converting all bid formats to RPM and taking a weighted average provides a concise summary of the expected revenue per ad impression. Expressing the fraction of each bid type as f, we can write:

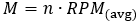

Sites often display more than one ad on each page, affording multiple ad impressions per pageview. For generalizability, we can define the average revenue per thousand pageviews (M). If a website displays ‘n’ ads per page:

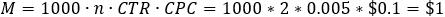

Putting this together, suppose we have a website which displays 2 CPC ads per page, has a clickthrough ratio of 0.5% and an average cost per click of $0.10. In this case, we’d expect a revenue of $1 per 1000 pageviews:

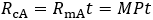

Next, we can evaluate the recurrent monthly revenue from a single article or webpage (RmA), through its monthly pageviews, in thousands (P):

We can also compute the article’s total cumulative revenue (RcA) after ‘t’ months:

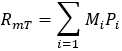

It is inevitable that different articles/webpages will have different average monthly pageviews and/or RPM. We can forecast the total monthly revenue of a website (RmT) by summing the monthly revenue of each of its webpages:

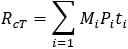

Alternatively, we can compute the cumulative revenue of the entire website (RcT) by including the age of each article, in months (t):

Ad revenue under regular content addition

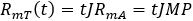

How does the monthly and cumulative revenue of a website grow as content is added to it regularly? Consider a website whose articles, on average, each receive ‘P’ monthly pageviews (in thousands) and earn average revenue per thousand pageviews ‘M’. Furthermore, suppose ‘J’ new articles are added each month. Since each article is expected to increase the monthly revenue by M*P, after ‘t’ months it will be:

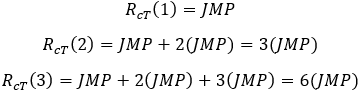

More interestingly, observe how the cumulative revenue grows:

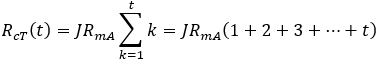

Continuing this trend, we get sequence 1, 3, 6, 10, 15, 21… These are the triangular numbers, the sum of consecutive whole numbers:

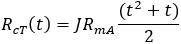

The partial sum of this classic sequence is known. We can compute Rct(t) conveniently as:

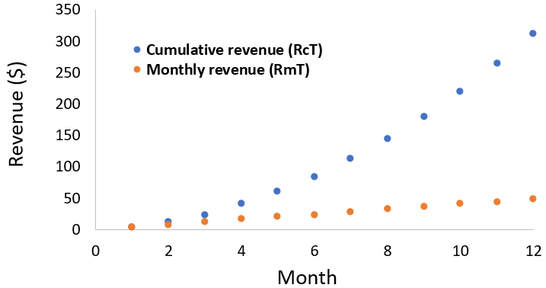

To visualize how revenue grows over time in this model, suppose an average article generates a monthly revenue RmA = $1/month and 4 articles are published per month (J):

The monthly revenue grows linearly and therefore the cumulative revenue grows quadratically. This highlights the importance of patience in developing an online business. Though $1 per month per article doesn’t seem like much, the wealth accumulates over long periods of time.

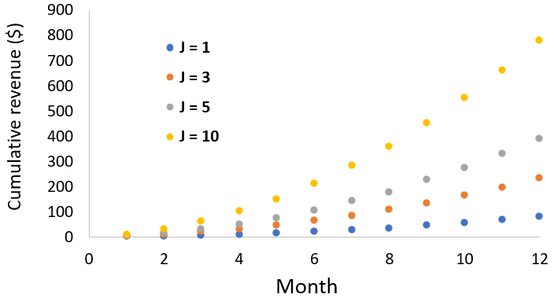

The number of articles written per month (J) is a key parameter in this model, whose cumulative effects become increasing large with time. If we continue to suppose RmA = $1/month and we vary J:

The number of articles written per month (J) is a key parameter in this model, whose cumulative effects become increasing large with time. If we continue to suppose RmA = $1/month and we vary J:

The relative revenue growth is proportional to the number of articles written per month. The additive nature of this growth this translates into an increasingly large revenue difference. For instance, after a year we’d accumulate $780 having written ten articles per month, but only $78 if we’d written one per month. Overall, this shows that writing content regularly is essential for a website or blog’s financial success.

Reputational and audience growth

Through exposure on the internet, a website may build an increasingly large returning audience. Furthermore, as the website’s reputation and Google PageRank increases over time, the search performance of all articles may improve. Thus, revenue may grow above and beyond what was modelled above. It is reasonable to treat both growth processes as exponential, at least for new/emerging websites. Exponential growth requires that the rate of growth be proportional to the current size of the value, a likely property of both the audience size and the PageRank of a website. When a user visits a website and finds it useful, there is some probability that they will link to the webpage, share it on social media, or recommend it to friends. Some of the resulting new users may further spread it through these mechanisms. Overall, this process can give exponential growth in audience size. Furthermore, having more backlinks increases PageRank and organic search traffic. This in turn leads to more pageviews and faster organic link building.

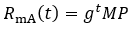

In conclusion, the pageviews of new/emerging websites are expected to increase at some exponential growth rate, g (expressed monthly). For instance, a website whose reputation/audience grows 1% per month would have g = 1.01. Now the average monthly revenue of an article increases with time:

In conclusion, the pageviews of new/emerging websites are expected to increase at some exponential growth rate, g (expressed monthly). For instance, a website whose reputation/audience grows 1% per month would have g = 1.01. Now the average monthly revenue of an article increases with time:

Here P denotes the average pageviews expected without audience/reputational growth. The growth term exponentially increases the monthly pageviews and revenue. If J articles are added to the website per month:

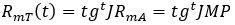

To show the effect of the growth rate on monthly revenue, I calculate monthly revenue given J = 4 and M*P = $1/month:

The growth process gives an exponential increase in revenue over time. Unsurprisingly, the revenue takes off much faster at higher growth rates. Over long timescales however, even small growth coefficients can give substantial improvement in revenue.

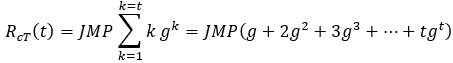

We can also calculate how exponential website growth affects the total cumulative revenue (RcT):

We can also calculate how exponential website growth affects the total cumulative revenue (RcT):

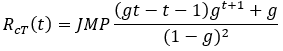

Evaluating this partial sum gives:

This function conveniently gives the expected cumulative revenue, accounting for monthly content addition and exponential growth. However, note that if we let g = 1 the dominator becomes zero and we get an indeterminate form. At this discontinuity, we must apply the original cumulative revenue function without the growth parameter. This can be seen by evaluating the limit:

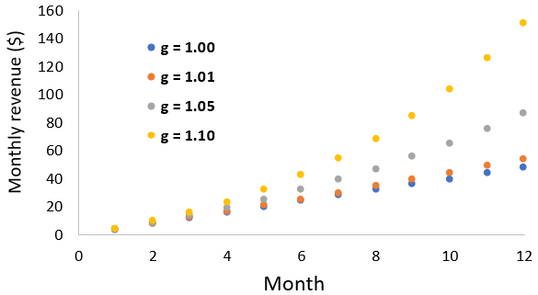

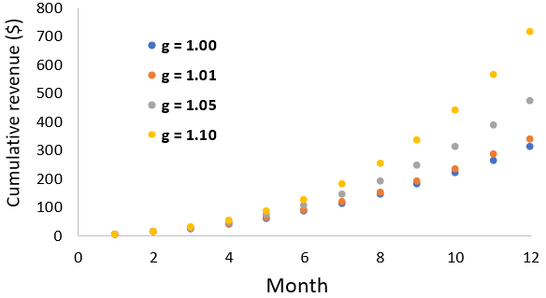

To visualize the cumulative revenue under exponential growth, consider a website with J = 4 and M*P = $1/month:

As before, the growth process gives an exponential increase in revenue with greatest benefit at high growth rates. However, I emphasize that this growth model applies only for new/emerging websites. As a website saturates its niche and potential audience, the growth rate must tapper off and plateau. For instance, the amount of organic search traffic an article receives is bounded by the total number of monthly searches for its keywords.

When does a growing website become profitable?

Thus far, all calculations have dealt only with revenue. Though increasing revenue is encouraging, profit is a more balanced descriptor of a business’s finances. In this section I evaluate how long it takes a website monetized with ads to become profitable. I develop these equations for the monthly content addition model. I neglect audience/reputational growth in this section to simplify the mathematics.

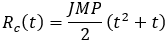

If the business’s only expense is recurrent fees, such as website hosting and renting a domain name, then we have constant monthly expenses (Em). The monthly profit (Pm) is given by the difference between that month’s revenue (Rm) and expenses:

If the business’s only expense is recurrent fees, such as website hosting and renting a domain name, then we have constant monthly expenses (Em). The monthly profit (Pm) is given by the difference between that month’s revenue (Rm) and expenses:

If we assume J new articles are written each month as before, this gives:

Note that the monthly revenue increases with time (as more articles are written), but the expenses are constant over time. The website’s first profitable month will be achieved at time ‘tmp,’ when the revenue exceeds expenses:

The brackets denote the ceiling function, which rounds up to the nearest greater integer number. This equation has a simple, but important implication: any website which has content added to it regularly and is monetized with ads will eventual become profitable. This is a consequence of how income incrementally grows but expenses stay constant.

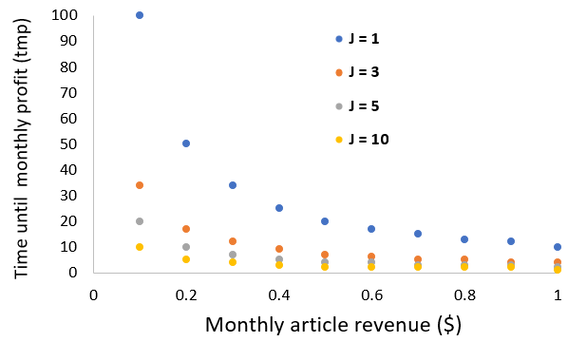

To develop an intuition for this relation, I show calculations below assuming Em = $10/month and varying J, M*P:

To develop an intuition for this relation, I show calculations below assuming Em = $10/month and varying J, M*P:

Having high average article revenue and/or producing content frequently allows the website to achieve its first profitable month relatively quickly. Since the number of articles written is what we have most control over, this is a parameter worth focusing on.

Reaching the first profitable month is a key milestone for the viability of an online business. However, considering all the months of financial loss before this point, it does not demarcate net profit. To calculate when a net profit (Pc) is attained, we must consider the cumulative finances.

Reaching the first profitable month is a key milestone for the viability of an online business. However, considering all the months of financial loss before this point, it does not demarcate net profit. To calculate when a net profit (Pc) is attained, we must consider the cumulative finances.

Since we have constant monthly expenses, the cumulative expenses (Ec) increase linearly with time:

As before, considering a website with J articles contributed each month, the cumulative revenue is given by:

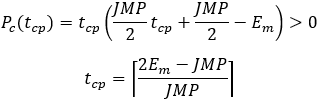

Combing these expressions shows that profit increases quadratically with time in this model:

The net profit becomes positive when the total revenue exceeds the expenses, at month tcp:

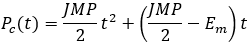

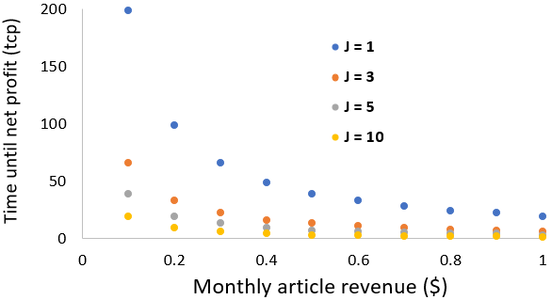

To explore this relationship, I calculate tcp given Em = $10/month and varying J, M*P:

As before, maximizing average article revenue and/or producing content frequently are essential for achieving net profit. This target takes significantly longer to achieve than merely attaining monthly profit (tmp). All past loss must be paid back in the former case, but not the latter.

The present value of an article

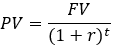

If the pageviews and average CPM of an article/webpage remain roughly constant over time, we can accurately think of its ad revenue as a recurrent cashflow. When appraising the financial value of this, it may be tempting to think that it will increase without bound; if we wait long enough, we can collect any amount of revenue. However, the financially literate among my audience will recognize the naivety of this. Money now is fundamentally more valuable than money later. For instance, a contract where you’d receive a dollar today is more valuable than one where you’d receive it in twenty years. We can relate the future value (FV) of an income to its present value (PV) through the interest rate (r). After t months at monthly interest rate, r:

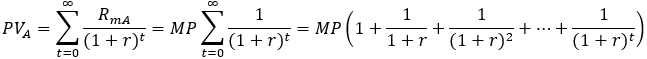

The present value of an article (PVA) is the summed present value of each monthly income (RmA) it will yield.

Evaluating this infinite sum yields a remarkably simple result:

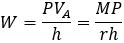

Calculating the present value allows us to determine if writing website content makes financial sense. By noting how many hours (h) it took to write an article, we can compute an effective hourly wage (W) for creating it:

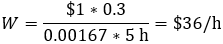

Now suppose realistic values for these parameters: the article took 5 hours to write (h = 5), earns a dollar per thousand pageviews (M=$1), and receives 300 pageviews per month (P=0.3). The article will return a mere $0.3 in ad revenue each month. However, at a monthly interest of 0.167% (2% interest/year):

Therefore, although 30 cents per month from an article doesn’t seem very significant, the recurrent nature of this income makes it worthwhile.

Forecasting pageviews through seasonal periodicities

The previous calculations have predicted the number of monthly pageviews a given article will receive through its overall past average. Though a reasonable coarse-grained model, this treatment has a generally untrue assumption: that expected pageviews are independent of month/season. Many search terms do follow annual cycles in popularity, these can be explored conveniently using Google Trends.

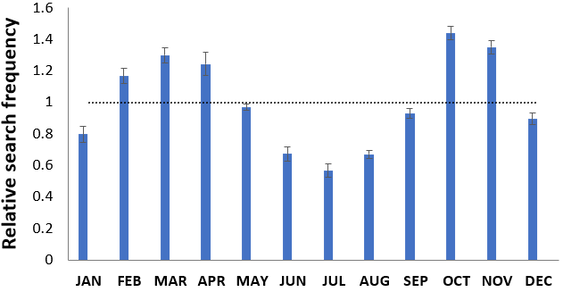

Since my website’s content is technical/educational in nature, much of my views are from students. It isn’t surprising that I see peak traffic in the middle of the fall and winter academic semesters. Google Trends data corroborate this trend. For instance, below I summarize the annual periodicity in search volume for the term “enzyme kinetics,” a term related to several of my articles. I’ve averaged Google’s worldwide data from 2012 to 2018 and normalized the values to have a monthly average of 1.

Since my website’s content is technical/educational in nature, much of my views are from students. It isn’t surprising that I see peak traffic in the middle of the fall and winter academic semesters. Google Trends data corroborate this trend. For instance, below I summarize the annual periodicity in search volume for the term “enzyme kinetics,” a term related to several of my articles. I’ve averaged Google’s worldwide data from 2012 to 2018 and normalized the values to have a monthly average of 1.

The dashed line represents the term’s annual average search volume. Note the dramatic dip that occurs over the summer months (June to August), when there are globally fewest students taking courses. Likewise, months in the middle of academic semesters offer peak search frequency (March/April and October/November). This type of seasonal periodicity is common among educational queries.

Most websites target narrow niches. A consequence of this is that much of the content may share a common seasonal periodicity in pageviews/ad revenue. This is something that website owners should be aware of and anticipate, since unexpected drops in revenue can be discouraging. If consistent ad revenue is desirable there are strategies available to mitigate these fluctuations. Writing some content that targets keywords without much seasonal variance would help. Alternatively, producing content with opposite seasonal periodicity would counterbalance the existing bias.

It is possible to include the seasonal periodicity of pageviews in the revenue models, if data on the periodicity of each article are available. This is easy to get a hold of for organic search through Google Trends. However, this does not necessarily faithfully represent periodicities in other traffic sources, like social media or direct traffic. For these, the accumulation of your site’s own analytic data over years is the best source. Nonetheless, in lieu of these data the search data is a viable proxy. To adjust the pageviews for seasonal periodicity, we merely multiply its annual average (P) by the month’s search frequency (f). This works because we normalized the monthly average frequency to “1.” An article’s ad revenue at month ‘i’ is still the product of its pageviews and revenue per pageview (M). However, the number of pageviews is now a function of month through the search frequency:

Most websites target narrow niches. A consequence of this is that much of the content may share a common seasonal periodicity in pageviews/ad revenue. This is something that website owners should be aware of and anticipate, since unexpected drops in revenue can be discouraging. If consistent ad revenue is desirable there are strategies available to mitigate these fluctuations. Writing some content that targets keywords without much seasonal variance would help. Alternatively, producing content with opposite seasonal periodicity would counterbalance the existing bias.

It is possible to include the seasonal periodicity of pageviews in the revenue models, if data on the periodicity of each article are available. This is easy to get a hold of for organic search through Google Trends. However, this does not necessarily faithfully represent periodicities in other traffic sources, like social media or direct traffic. For these, the accumulation of your site’s own analytic data over years is the best source. Nonetheless, in lieu of these data the search data is a viable proxy. To adjust the pageviews for seasonal periodicity, we merely multiply its annual average (P) by the month’s search frequency (f). This works because we normalized the monthly average frequency to “1.” An article’s ad revenue at month ‘i’ is still the product of its pageviews and revenue per pageview (M). However, the number of pageviews is now a function of month through the search frequency:

This correction can broadly be implemented to any of the modelling done earlier in this article, should any reader be interested in doing so. However, if we are only interested in a longer term annual prospective, we needn’t worry about this phenomenon. This periodicity averages out over a year:

Awareness of the seasonal periodicity of traffic and ad revenue is useful for accurately projecting what the annual averages will be. For instance, suppose I wrote a new article about enzyme kinetics and recorded the revenue it generated over July. If I projected this to be its monthly average, I’d likely be quite wrong. This is expected to be a slow month for the search term, fewer pageviews and ad revenue should be anticipated. Recognizing this, we can estimate its average monthly revenue (RmA) by dividing the month’s revenue by its search frequency value (f):

Suppose the enzyme kinetics article earned $1 over July. The search frequency value for its keyword is 0.57, so we can project the annual average to be $1.75. An implicit assumption required here is that there is no seasonal variance in the RPM of the ads the article displays.

Lastly, the overall seasonal periodicity in a website’s earnings can be determined by averaging the revenue distributions of all its articles:

Lastly, the overall seasonal periodicity in a website’s earnings can be determined by averaging the revenue distributions of all its articles:

Conclusion

In this article, I’ve developed several models forecasting website ad revenue. I hope that these equations will be useful tools for other website owners toward understanding and planning their finances. However, my principle goal was to explore the principles affecting a website’s ad revenue. I also wanted to understand if achieving significant income from online advertising was a realistic goal. Optimistically, my analysis here showed that this should be possible, even in niches that afford low RPM advertising. Beginning with a new website, it may not be intuitive that this is so. Distilling the results from these models, I offer fellow website owners the following advice:

-Produce quality, new content regularly and in sufficient quantity. This is ultimately your business’s product. Ad revenue will be in proportion to how much you’ve written and how much value you’ve provided users.

-Be patient. All the processes which develop a new website into a profitable business require long periods of time to get going. With regular writing, the passage of time is still required to amass a large body of content. Furthermore, reputational/audience growth also takes time. Since this process may be exponential, the initial period can be discouragingly slow.

-Minimize monthly expenses. This can dramatically decrease the amount of time it takes for your online business to become profitable.

-Be aware of seasonal periodicity in organic search/audience behavior. Minor fluctuations in traffic or revenue are often misleading, it is best to not over-analyze them. Recognizing the seasonal contribution to this offers some predictive power and can be reassuring.

-Produce quality, new content regularly and in sufficient quantity. This is ultimately your business’s product. Ad revenue will be in proportion to how much you’ve written and how much value you’ve provided users.

-Be patient. All the processes which develop a new website into a profitable business require long periods of time to get going. With regular writing, the passage of time is still required to amass a large body of content. Furthermore, reputational/audience growth also takes time. Since this process may be exponential, the initial period can be discouragingly slow.

-Minimize monthly expenses. This can dramatically decrease the amount of time it takes for your online business to become profitable.

-Be aware of seasonal periodicity in organic search/audience behavior. Minor fluctuations in traffic or revenue are often misleading, it is best to not over-analyze them. Recognizing the seasonal contribution to this offers some predictive power and can be reassuring.

RSS Feed

RSS Feed